$5.5 billion Visa Mastercard settlement: Who is eligible for a one-time payment?

- Written by Admin TOA

- Published in Businessman

Mastercard and Visa settled a class action lawsuit months ago that accused the global payment giants of violating antitrust laws to exploit merchants. Millions of businesses were forced to charge high fees to accept customers paying with Visa or Mastercard. Some are entitled to a payout to compensate for the negative effects these actions had on their livelihoods.

The settlement was been not welcome news for all. Interestingly, and unsurprisingly, the largest critics of the settlement came from major retail corporations, who accuse the negotiators of not fighting hard enough for major national retailers who represent the vast majority of sales using Visa or Mastercard.

Those eligible only have until February 4th, 2025 to submit their claim, and can do so through Payment Cards Settlement. The online claims process works for those with a client ID because they were sent a claim form in the mail. Those without the form can still submit their claim using their Taxpayer Identification Number. Distribution of the claim forms began in early December 2023 and continued on a rolling basis.

The class action’s eligibility covers “all persons, businesses, and other entities that have accepted any Visa-Branded Cards and/or Mastercard-Branded Cards in the United States at any time from January 1, 2004, to January 25, 2019.”

Merchants who used Visa and Mastercard payment systems and were subjected to corporate collusion will be compensated.

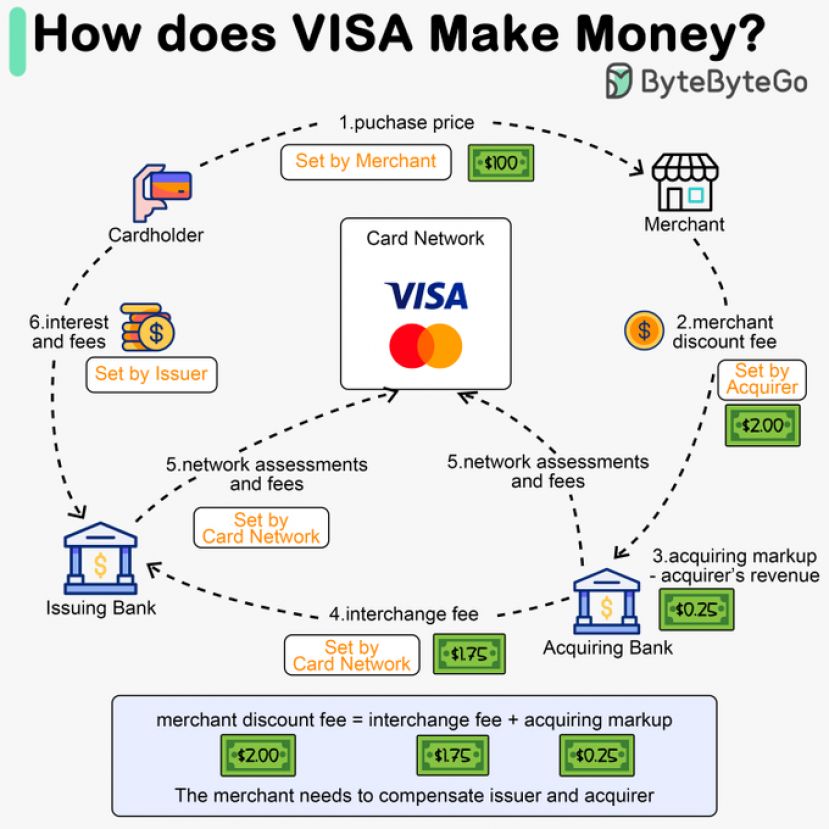

This case centers around Visa and Mastercard’s imposition of “interchange fees,” which are fees charged between banks for accepting card-based transactions. Corporate collusion allowed them to consolidate the market. The FAQ section with details on the case says the fees are “usually around 1% to 2% of the purchase price.”

The payment amounts will vary as they are “based on your actual or estimated interchange fees attributable to Visa and Mastercard card transactions” during the above-mentioned window.

Source: Story by Maite Knorr-Evans, Gidget Alikpala - msn.com

Latest from Admin TOA

- The Shared Pulse by Eda Uzunkara

- NEO HUMAN 10.0: How Will the Future Be Shaped? (Filiz Dag)

- Calculatit.net Is Bringing Pricing Transparency to America’s Construction Industry

- Support Independent, Trustworthy Journalism

- Fat Sal’s Italian Specialties Welcomes Customers in Bayville, NJ with a Renewed Concept