Unity Bank’s Turkish Team

Unity Bancorp, Inc. Clinton is a 19-branch-bank headquartered in New Jersey. It operates in Bergen, Hunterdon, Middlesex, Somerset, Union, and Warren counties of New Jersey as well as in Lehigh Valley, Pennsylvania. Three Turkish executives work in the bank, which has total assets of 2 billion dollars. Emre Haşmet, Evrim Çiçek and Nihal Birdir are a gateway to the Turkish-American community at the bank with nearly 200 employees.

Evrim Çiçek, who previously had career experiences at national banks such as PNC and Chase, has been working as the regional manager at the bank since February 2018. Çiçek graduated from The School of Economics, Dumlupinar University in Turkey and had a master's degree in accounting and finance at DeVry University in the US. She worked as deputy branch manager for six years in the Warren, New Jersey branch of JP Morgan Chase, one of the leading banks in America, and worked as a branch manager at PNC Bank between 2014 and 2018. Çiçek joined the Unity Bank family in January 2018 and got promoted to regional manager in May 2020. After gaining experience in big national banks, she considers Unity Bank, which is classified as a community bank, as a warm and friendly environment. "While working in big banks, you do not have much opportunity to use initiative. Here, the customer-banker relationship is more intimate" she says.

- Published in Professionals

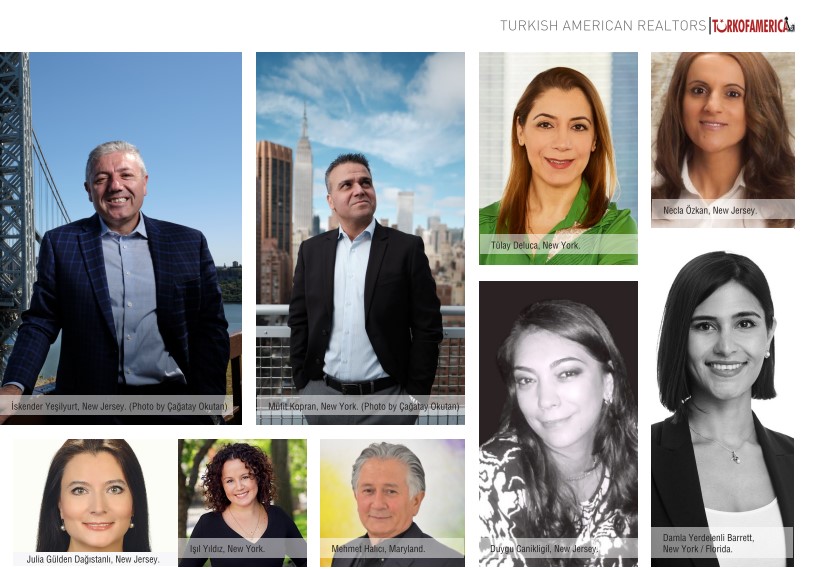

By Cemil Özyurt - According to TURKOFAMERICA’s research, there are over 500 real estate professionals who have been actively selling and buying homes, renting residential and commercial spaces. The Association of Real Estate License Law Officials (ARELLO) estimates that there are about 2 million active real estate licensees in the United States. There are 106,548 real estate brokerage firms operating as well. Trulia, the real-estate listings and data portal, searched nearly 83,000 agent profiles in the U.S. in 2014 to find the most commonly spoken languages. The most popular, after English, was Spanish at 12.2%, followed by French with 2.5%, Russian, Mandarin and German. About 15% of real-estate agents report speaking a second language, according to the National Association of Realtors. Majority of Turkish-American real estate professionals work in New York, New Jersey, Florida, California, and Texas. There are approximately 250 real estate professionals work in New York, New Jersey and about 100 of them operate in Florida.

By Cemil Özyurt - According to TURKOFAMERICA’s research, there are over 500 real estate professionals who have been actively selling and buying homes, renting residential and commercial spaces. The Association of Real Estate License Law Officials (ARELLO) estimates that there are about 2 million active real estate licensees in the United States. There are 106,548 real estate brokerage firms operating as well. Trulia, the real-estate listings and data portal, searched nearly 83,000 agent profiles in the U.S. in 2014 to find the most commonly spoken languages. The most popular, after English, was Spanish at 12.2%, followed by French with 2.5%, Russian, Mandarin and German. About 15% of real-estate agents report speaking a second language, according to the National Association of Realtors. Majority of Turkish-American real estate professionals work in New York, New Jersey, Florida, California, and Texas. There are approximately 250 real estate professionals work in New York, New Jersey and about 100 of them operate in Florida.