Symantec Sells SSL Business to DigiCert for $950M in Cash and 30% Shares

- Written by Admin TOA

- Published in Technology

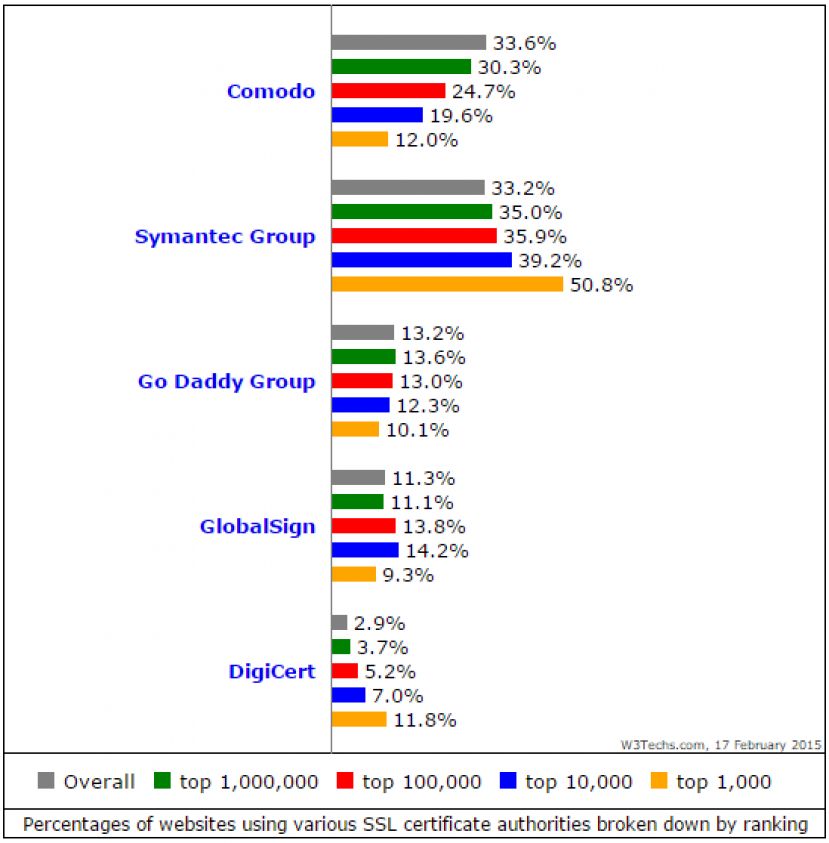

The Symantec Group with its brands GeoTrust, Thawte and Verisign has been the leading SSL certificate authority up to now, but has been dethroned by Comodo, whose market share climbed to 33.6% compared to 33.2% for Symantec.

The Symantec Group with its brands GeoTrust, Thawte and Verisign has been the leading SSL certificate authority up to now, but has been dethroned by Comodo, whose market share climbed to 33.6% compared to 33.2% for Symantec.

In the face of devastating penalties prepared by Google, Symantec announced plans to sell its SSL issuance certificate business to rival company DigiCert. The price of the acquisition is $950 million in upfront cash and a 30 percent stake in DigiCert stock at the closing of the transaction. At the time of writing, Symantec was the third largest SSL provider on the market after Comodo and IdenTrust, with a market share of 14% and SSL certificates running on 5.5% of the Internet's domains. DigiCert is ranked sixth with a 2.2% market share and certificates on 0.9% of the Internet's sites. On the other hand, DigiCert has a bigger presence in the IoT market, where its SSL certs are often used to encrypt traffic between smart devices and vendor servers.

Rumors first surfaced about Symantec looking for buyers three weeks ago. The reason why the company sold its business is because of a series of sanctions Google was preparing to impose on Symantec SSL certificates.

By late 2018, Google was planning to remove trust in all SSL certificates Symantec ever issued. Google was penalizing Symantec because they and Mozilla engineers discovered that the company had mis-issued over 30,000 SSL certificates to the wrong persons/entities.

Google gave Symantec a chance to remain on the SSL issuance market, but the company had to issue Symantec-branded certificates through a third-party SSL provider starting December 1, 2017.

Symantec also had the option to rebuild its SSL issuance business from scratch. The decision to sell was Symantec's way of avoiding rebuilding its entire business and ride into the sunset with a giant bag of money.

The price of the deal is what Symantec was looking for in mid-July, according to a Reuters report.

Comodo, Symantec's main rival, is ecstatic about Symantec's decision to offload its SSL issuance business.

Previously, Symantec bought Blue Coat (enterprise products) for $4.65 billion, LifeLock (consumer security products) for $2.3 billion, and sold its Veritas (data storage) division for $7.4 billion. By Catalin Cimpanu * www.bleepingcomputer.com

Related items

- Comodo CA Reports Record Growth

- Comodo Leads Global Secure Sockets Layerv Certification Market

- Comodo Launches Free Service to Remove Website Malware

- Francisco Partners Acquires Comodo CA business

- Comodo Advanced Endpoint Protection Wins 'APT Software of the Year' 2017 CyberSecurity Breakthrough Award

Latest from Admin TOA

- World Energy Council Türkiye Holds the Opening Meeting of the Young Energy Leaders (YEL’26) Program

- The Shared Pulse by Eda Uzunkara

- NEO HUMAN 10.0: How Will the Future Be Shaped? (Filiz Dag)

- Calculatit.net Is Bringing Pricing Transparency to America’s Construction Industry

- Support Independent, Trustworthy Journalism